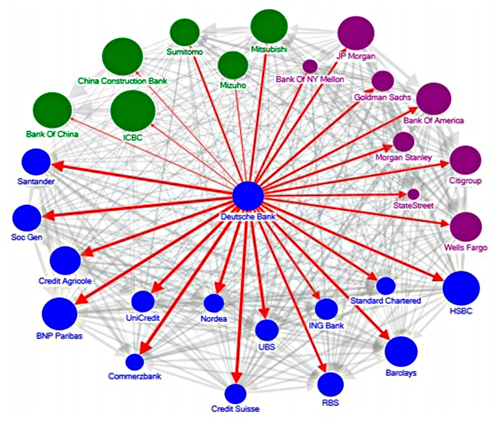

Systemic Risk Among Deutsche Bank and Global Systemically Important Banks (Source: IMF Report, 2016 — “The blue, purple and green nodes denote European, US and Asian banks, respectively. The thickness of the arrows captures total linkages (both inward and outward), and the arrow captures the direction of net spillover. The size of the nodes reflects asset size.”)

By Pam Martens and Russ Martens: March 24, 2023 ~

The reassurances of Federal Reserve Chairman Jerome Powell and U.S. Treasury Secretary Janet Yellen that the U.S. banking system is sound, stand in sharp contrast to what is happening in markets. This week, the shorts have found another easy new global bank target to try to take down after making a bundle of money betting against Credit Suisse, which was taken over for 82 cents a share on Sunday by its Swiss competitor, UBS.

This time the global banking target is Deutsche Bank, a global behemoth we have warned about ad nauseum here at Wall Street On Parade. Deutsche Bank was a $120 dollar stock prior to the financial crisis in 2008. It closed yesterday at $9.65 in New York and is down another 10 percent in early morning trading in Europe.

The weakness in Deutsche Bank is spilling over into other European bank stocks this morning in European trading with Commerzbank, UBS and Societe Generale also showing weakness. This has, in turn, led to losses in Dow futures here in the U.S., which were, around 7:30 a.m. ET, suggesting a loss of about 300 points in the Dow at the open.

Deutsche Bank is an easy target for short sellers for a long laundry list of reasons. Let’s start with the fact that this bank’s headquarters in Germany has been raided by police so often that it’s become a big yawn to mainstream media here in the U.S. And then there’s the pesky detail of bodies turning up.

On November 29, 2018, Deutsche Bank’s headquarters in Germany was raided by 170 members of law enforcement. Prosecutors explained the reason for the raid as “Deutsche Bank helped customers found offshore organizations in tax havens by transferring illegally acquired money without alerting authorities to suspected money laundering.”

On September 24-25, 2019, the German police raided Deutsche Bank headquarters again. That raid was related to the $220 billion money laundering probe of Danske Bank, Denmark’s largest bank. Deutsche Bank served as correspondent bank to Danske’s Estonia branch where the laundering is alleged to have occurred. On September 25, as the raid was ongoing, the body of Aivar Rehe who previously ran the Estonia business of Danske Bank, was discovered by police in Estonia. Rehe had been questioned by prosecutors and was considered a key witness in the probe. Rehe’s death was ruled a suicide.

On April 29, 2022, Deutsche Bank was raided again. The Financial Times reported that “Germany’s federal police office, criminal prosecutors and the country’s financial watchdog BaFin are raiding Deutsche Bank’s headquarters in Frankfurt” this morning, according to a statement from prosecutors.

The April raid came just four days after the body of Valentin (Val) Broeksmit, 46, was discovered on the grounds of Woodrow Wilson High School in El Sereno, California, just outside of Los Angeles. Val Broeksmit was the son of William Broeksmit who was found hanged in his London home on January 26, 2014. The senior Boreksmit had been a key executive at Deutsche Bank involved in assessing risk on the bank’s balance sheet.

According to a profile of Val Broeksmit written by David Enrich in the New York Times in 2019, the younger Broeksmit had obtained “a cache of confidential bank documents” left by his father that provided a “tantalizing” look into the internal workings of Deutsche Bank. Val Broeksmit was sharing the documents with the FBI.

Deutsche Bank had attempted to merge with Commerzbank in 2019 but the deal fell through, resulting in Deutsche Bank announcing plans to fire 18,000 workers in July 2019. Deutsche Bank also said it would be creating a good bank/bad bank, to separate toxic assets that it planned to sell.

Deutsche Bank is heavily interconnected to Wall Street mega banks as a result of its activities as a derivatives counterparty. In June 2016, the International Monetary Fund (IMF) released a report indicating that Deutsche Bank posed the greatest threat to global financial stability because of its interconnections to other global banks. (See graph above.) JPMorgan Chase, the largest federally-insured bank in the United States, was one of the global banks with the largest amount of exposure to Deutsche Bank at that time.

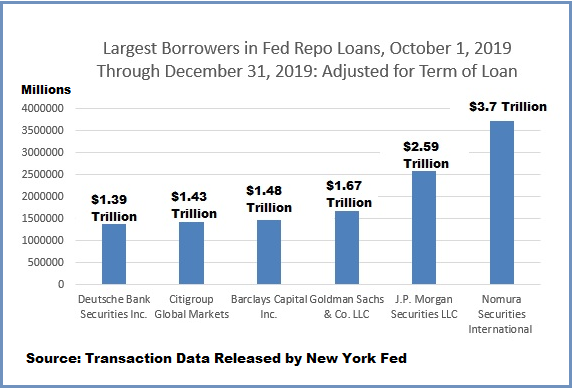

There is another deeply troubling connection between JPMorgan Chase and Deutsche Bank. Both mega banks were secretly tapping trillions of dollars in cumulative repo loans from the Fed, beginning in September 2019 and accelerating into the last quarter of 2019.

These emergency repo loans from the Fed began on September 17, 2019 and dramatically increased in size into the fourth quarter of 2019. This, as yet to be explained banking crisis, occurred months before anyone had heard of a COVID pandemic anywhere in the world.

According to the transaction data released by the New York Fed two years after the repo loans began, out of the 25 primary dealers that were taking these loans in 2019, JPMorgan Chase ranked number two in the dollar amounts borrowed in the fourth quarter of 2019; Deutsche Bank ranked number six. (See chart below.)

And then there is Deutsche Bank’s rap sheet of serial charges by the U.S. Department of Justice and regulators. For example:

April 23, 2015: Deutsche Bank pleads guilty to the U.S. Department of Justice for its role in rigging the benchmark interest rate known as Libor. It pays fines of $2.519 billion to various regulators.

January 17, 2017: Deutsche Bank reaches a settlement with the U.S. Department of Justice in which it agrees to pay $7.2 billion in fines and restitution for its improper “packaging, securitization, marketing, sale and issuance of residential mortgage-backed securities (RMBS) between 2006 and 2007.”

January 30, 2017: Deutsche Bank is fined a total of $630 million by U.S. and U.K. regulators over claims it laundered upwards of $10 billion on behalf of Russian investors.

January 29, 2018: Deutsche Bank is ordered to pay $30 million by the Commodity Futures Trading Commission for manipulating trading in the precious metals market.

November 8, 2019: Nomura and Deutsche Bank, along with numerous employees, were convicted in a trial in Italy for helping the Tuscan bank, Monte dei Paschi di Siena, commit fraud in derivatives deals to help it hide losses.

January 18, 2020: The Commodity Futures Trading Commission fines Deutsche Bank $10 million to settle two cases: one involving failure to properly report swap transactions and the other for spoofing.

July 7, 2020: The New York State Department of Financial Services settles a state civil matter with Deutsche Bank for $150 million over its involvement with child sex trafficker Jeffrey Epstein.

October 13, 2020: The Frankfurt, Germany Public Prosecutor’s Office fined Deutsche Bank €13.5 million for failing to submit Suspicious Activity Reports in a timely fashion regarding potential money laundering activities.

January 8, 2021: The Justice Department and Securities and Exchange Commission settle charges against Deutsche Bank for $120 million for violating the Foreign Corrupt Practices Act. The charges related to paying bribes to foreign officials to obtain business.

Unfortunately, this global German bank is not alone in terms of a breathtaking rap sheet. See JPMorgan Chase’s rap sheet here, which includes an unprecedented five felony counts.

If “rap sheets” and “sound banking system” don’t sound compatible to your brain, congratulate yourself. You haven’t yet been brainwashed by the banking cartel and its captured regulators.